Our Expertise

TenDelta differentiates itself by blending capital markets knowledge with deep-rooted technical expertise; this drives how we develop solutions.

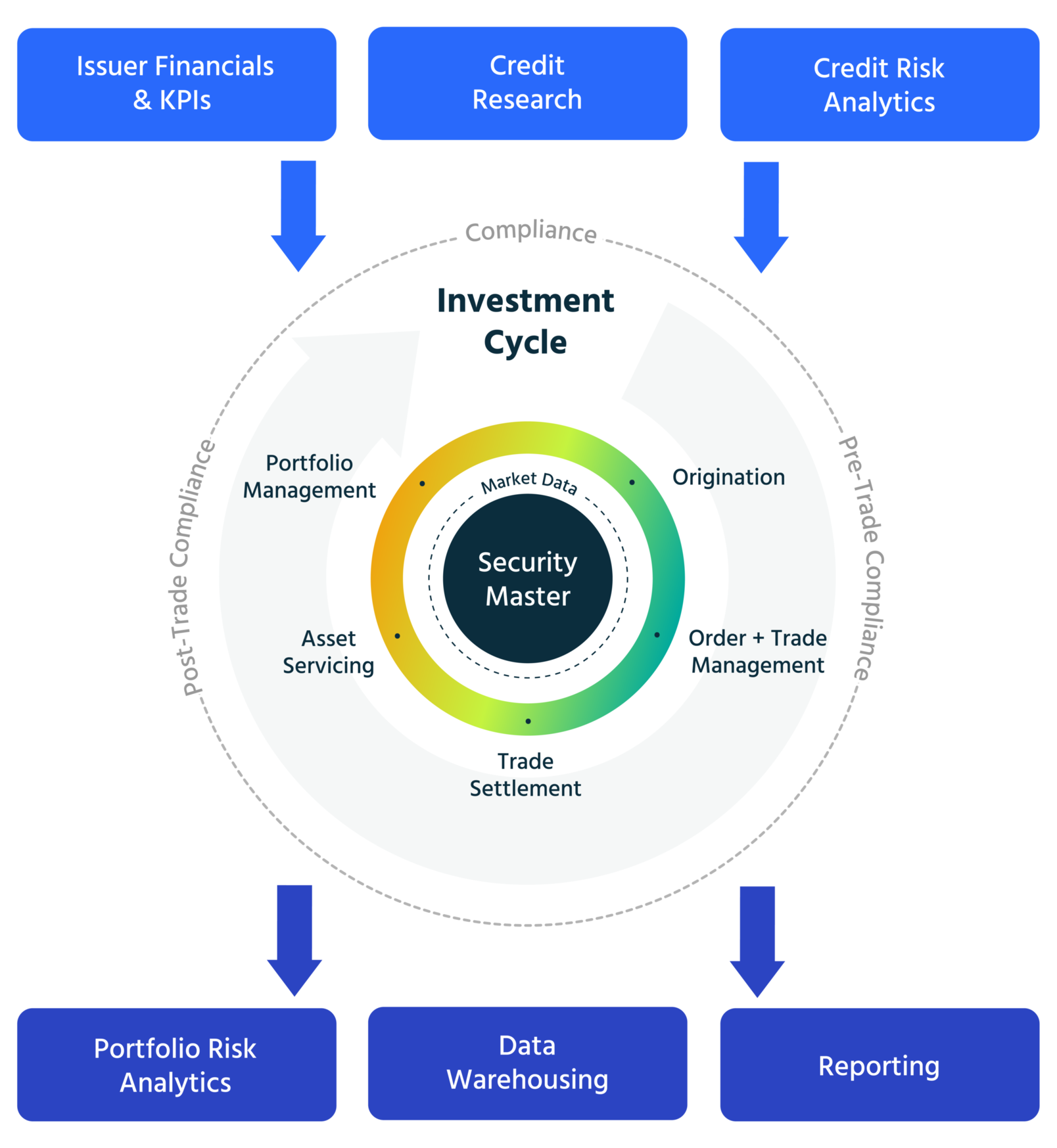

Flexible credit agreements require investment managers to administer a notoriously wide array of position management and accounting scenarios. Whether the strategy is to outsource, build out or refine middle-office solutions, we help clients foresee and handle asset servicing complexities in the most risk-mitigated and efficient manner possible. This insight is as much to do with process and clear data flow as it is with technology innovation.

Compliance, as with most intricate calculation engines, relies of three key elements: (i) current & historical data sourcing, (ii) calculation definitions and (iii) a user experience that is intuitive.

In our experience, ensuring data integrity around the engine (e.g. security master, positions, etc.) is key to laying the right foundation. Following that, we invest time into building tools that certify underlying data sources, meticulously interpret documentation and obsess around intuitive ways to illustrate actual and hypothetical trading scenarios.

Credit analysis is a highly subjective topic. Credit managers differentiate by adopting bespoke analytical approaches, layered with appropriate qualitative commentary. We try and supplant ourselves within the investment review cycle; reconciling the way a portfolio manager may want to review a cohesive credit summary versus how analysts focus on the minutiae.

The goal, regardless of the path, is to create a portal which distills complex information into an insightful and precise decision-making engine.

Whether assessing the risk of an individual borrower or across an entire portfolio of loans and bonds, well-informed investment decisions start and end with data integrity. Risk analysis encompasses several key steps:

- Collecting and cleaning credit data

- Building statistical models to predict default probability and loss given default

- Evaluating the performance of the models

- Using the results to inform credit decisions and risk management strategies

We partner with our clients every step of the way to create customized, flexible solutions that allow them to confidently make these decisions and proactively mitigate risks.

Fintech usually excels in one of two categories: (i) capturing transactions or (ii) reporting on transactions. System modules are usually optimized to perform one or the other; the former requiring focus on decision support and live data/analytics, the latter providing the means to ‘mine’ for correlations, trends and key metrics.

Given our history on standards and system optimization, we focus on how data traverses through this ‘blood-brain barrier’ within our clients’ infrastructure. As one can imagine, smart transformations, data integrity and, attentiveness on data model design are all critical elements to establishing this equilibrium.

Portfolio diversification makes sense, the challenge comes when portfolio managers are faced with co-mingling universal financial metrics with industry-specific measures.

Our approach is to organize underlying financial statements with intelligent metadata and expose this ‘language’ in a manner that allows for ‘apples-to-apples’ comparison, as well as, ‘apples-to-oranges’ analysis ensuring that investment decisions are supported with appropriate KPI-driven justification.

Deal origination, structuring and establishment culminates in a process of investment allocation based on underlying strategies. We focus on:

- A healthy dose of ‘pre-order’ data integrity checks (security master, pricing, ratings etc.)

- Establishing a clear delineation between order placement (potential multi-asset hypo scenarios) and order fulfillment

- Ensuring clear (systemic) bi-directional communication between trade execution and the appropriate settlement engines.

Managing the complexities of the origination process presents a significant challenge for credit teams. By collaborating with key stakeholders, we ensure that data is captured and managed by the appropriate teams at each stage of the lifecycle. Through the utilization of advanced technologies and data-driven methodologies, we deliver the tools and infrastructure necessary to streamline origination workflows, enabling clients to effectively identify and capitalize on investment opportunities.

From cash forecasting to the final investment decision, our tailored solutions empower clients to source, evaluate, and manage potential investments with precision and confidence.

Portfolio management is a ‘live’ process – analysts continuously research to monitor performance and make tweaks in real time to achieve investment goals.

Our solutions start with an analysis of the data – from Excel workbooks to cloud applications to in-house software. Once the data is centralized, we provide customized tools to ‘slice and dice’ the portfolio – whether by industry, rating, or the analyst responsible for the deal. Our clients are equipped to make data-driven decisions to maximize return and minimize risk.

Historical and future trend analysis is critical when assessing potential risk across a portfolio of investments. Your data must be accurate in order to properly analyze and prepare for likely (or unlikely!) scenarios.

Whether an asset manager is looking to understand past and future performance of an investment, or mitigate risk across a portfolio to meet regulatory reporting requirements, we build solutions that facilitate a comprehensive risk analysis. System-built scenario modeling and stress testing save our clients time and money – allowing them to make informed decisions in real-time.

Every client’s reporting wants are different, but all of our clients need timely reporting that relies on accurate, centralized data.

We pride ourselves on creating clean, stylish reporting outputs that are customized to our clients needs and brand standards, satisfying requirements for both internal and external consumers. From quarterly Credit Monitoring reports across the entire organization to weekly Statement of Investments reports by fund, we combine our industry knowledge and design standards to create reports that meet your unique needs.

Asset and Issuer data often resides within one or more systems, and clients may also have specific internal data points that are maintained manually. With so much room for error, it’s easy to see why clients have issues with other downstream processes, such as valuation or credit reporting.

We partner with our clients to ensure data is accurate from inception. We build solutions to help systems communicate, creating a comprehensive system-to-system mapping and a solid set of data validation rules to keep data consistent between the various systems. Building intuitive, easy-to-use processes within systems reduces manual entry and errors, leaving clients with a complete and accurate picture of their data to inform investment decisions.

Trade Settlement cycles can vary, but the root of an effective settlement process requires accurate data – from the asset characteristics to the trade-specific funding details. Additionally, clear and reliable settlement system communication is key to ensuring accurate reporting and real-time holdings.

With our years of experience and depth of industry knowledge, we are able to confidently advise on the many facets of the trade settlement process – resulting in a smooth, accurate process for our clients, from order management to reconciliation.

Flexible credit agreements require investment managers to administer a notoriously wide array of position management and accounting scenarios. Whether the strategy is to outsource, build out or refine middle-office solutions, we help clients foresee and handle asset servicing complexities in the most risk-mitigated and efficient manner possible. This insight is as much to do with process and clear data flow as it is with technology innovation.

Compliance, as with most intricate calculation engines, relies of three key elements: (i) current & historical data sourcing, (ii) calculation definitions and (iii) a user experience that is intuitive.

In our experience, ensuring data integrity around the engine (e.g. security master, positions, etc.) is key to laying the right foundation. Following that, we invest time into building tools that certify underlying data sources, meticulously interpret documentation and obsess around intuitive ways to illustrate actual and hypothetical trading scenarios.

Credit analysis is a highly subjective topic. Credit managers differentiate by adopting bespoke analytical approaches, layered with appropriate qualitative commentary. We try and supplant ourselves within the investment review cycle; reconciling the way a portfolio manager may want to review a cohesive credit summary versus how analysts focus on the minutiae.

The goal, regardless of the path, is to create a portal which distills complex information into an insightful and precise decision-making engine.

Whether assessing the risk of an individual borrower or across an entire portfolio of loans and bonds, well-informed investment decisions start and end with data integrity. Risk analysis encompasses several key steps:

- Collecting and cleaning credit data

- Building statistical models to predict default probability and loss given default

- Evaluating the performance of the models

- Using the results to inform credit decisions and risk management strategies

We partner with our clients every step of the way to create customized, flexible solutions that allow them to confidently make these decisions and proactively mitigate risks.

Fintech usually excels in one of two categories: (i) capturing transactions or (ii) reporting on transactions. System modules are usually optimized to perform one or the other; the former requiring focus on decision support and live data/analytics, the latter providing the means to ‘mine’ for correlations, trends and key metrics.

Given our history on standards and system optimization, we focus on how data traverses through this ‘blood-brain barrier’ within our clients’ infrastructure. As one can imagine, smart transformations, data integrity, and attentiveness on data model design are all critical elements to establishing this equilibrium.

Portfolio diversification makes sense – the challenge comes when portfolio managers are faced with co-mingling universal financial metrics with industry-specific measures.

Our approach is to organize underlying financial statements with intelligent metadata and expose this ‘language’ in a manner that allows for ‘apples-to-apples’ comparison, as well as, ‘apples-to-oranges’ analysis ensuring that investment decisions are supported with appropriate KPI-driven justification.

Deal origination, structuring, and establishment culminates in a process of investment allocation based on underlying strategies. We focus on:

- A healthy dose of ‘pre-order’ data integrity checks (security master, pricing, ratings etc.)

- Establishing a clear delineation between order placement (potential multi-asset hypo scenarios) and order fulfillment

- Ensuring clear (systemic) bi-directional communication between trade execution and the appropriate settlement engines.

Managing the complexities of the origination process presents a significant challenge for credit teams. By collaborating with key stakeholders, we ensure that data is captured and managed by the appropriate teams at each stage of the lifecycle. Through the utilization of advanced technologies and data-driven methodologies, we deliver the tools and infrastructure necessary to streamline origination workflows, enabling clients to effectively identify and capitalize on investment opportunities.

From cash forecasting to the final investment decision, our tailored solutions empower clients to source, evaluate, and manage potential investments with precision and confidence.

Portfolio management is a ‘live’ process – analysts continuously research to monitor performance and make tweaks in real time to achieve investment goals.

Our solutions start with an analysis of the data – from Excel workbooks to cloud applications to in-house software. Once the data is centralized, we provide customized tools to ‘slice and dice’ the portfolio in various ways, including by industry, rating, or the analyst responsible for the deal. Our clients are equipped to make data-driven decisions that maximize return and minimize risk.

Historical and future trend analysis is critical when assessing potential risk across a portfolio of investments. Your data must be accurate in order to properly analyze and prepare for likely (or unlikely!) scenarios.

Whether an asset manager is looking to understand past and future performance of an investment or mitigate risk across a portfolio to meet regulatory reporting requirements, we build solutions that facilitate a comprehensive risk analysis. System-built scenario modeling and stress testing save our clients time and money – allowing them to make informed decisions in real-time.

Every client’s reporting wants are different, but all of our clients need timely reporting that relies on accurate, centralized data.

We pride ourselves on creating clean, stylish reporting outputs that are customized to our clients needs and brand standards, satisfying requirements for both internal and external consumers. From quarterly Credit Monitoring reports across the entire organization to weekly Statement of Investments reports by fund, we combine our industry knowledge and design standards to create reports that meet your unique needs.

Asset and Issuer data often resides within one or more systems, and clients may also have specific internal data points that are maintained manually. With so much room for error, it’s easy to see why clients have issues with other downstream processes, such as valuation or credit reporting.

We partner with our clients to ensure data is accurate from inception. We build solutions to help systems communicate, creating a comprehensive system-to-system mapping and a solid set of data validation rules to keep data consistent between the various systems. Building intuitive, easy-to-use processes within systems reduces manual entry and errors, leaving clients with a complete and accurate picture of their data to inform investment decisions.

Trade Settlement cycles can vary, but the root of an effective settlement process requires accurate data – from the asset characteristics to the trade-specific funding details. Additionally, clear and reliable settlement system communication is key to ensuring accurate reporting and real-time holdings.

With our years of experience and depth of industry knowledge, we are able to confidently advise on the many facets of the trade settlement process – resulting in a smooth, accurate process for our clients, from order management to reconciliation.

Contact Us

Our team is eager to dive into your unique needs and collaborate on shaping the future together.